Abstract Session

Epidemiology, health policy and outcomes

Session: Abstracts: Health Services Research II (1615–1620)

1617: Comparing Uptake of Biosimilar Infliximab Among Patients with Medicare, Medicaid and Private Insurance in U.S. Rheumatology Practices 2016-2022

Monday, November 13, 2023

2:30 PM - 2:40 PM PT

Location: Room 33A-C

- ER

Eric Roberts, PhD, MPH

University of California, San Francisco

SF, CA, United StatesDisclosure information not submitted.

Presenting Author(s)

Eric Roberts1, Jing Li1, Nick Bansback2, Chien-Wen Tseng3, Steve Shiboski1, Gabriela Schmajuk4 and Jinoos Yazdany1, 1University of California San Francisco, San Francisco, CA, 2University of British Columbia, Vancouver, BC, Canada, 3University of Hawai'i John A. Burns School of Medicine, Honolulu, HI, 4UCSF / SFVA, San Francisco, CA

Background/Purpose: The first infliximab biosimilar (infliximab-dybb) entered the U.S. market in 2016, and two additional products have subsequently been introduced (infliximab-axxq (2017) and infliximab-abda (2020)). Biosimilars have significant potential to slow drug spending; however, uptake in the U.S. has lagged behind other countries. We compared rates of biosimilar uptake for Medicare, Medicaid, and private insurance after each infliximab biosimilar approval from 2016 to 2022.

Methods: Data from RISE, a national registry with electronic health records from one-third of U.S. rheumatology practices, was used. We examined all bio-originator or biosimilar infliximab administrations for users ≥ 18 years from the release of -dybb (biosimilar #1) in November 2016 through March 2022 regardless of diagnosis among participants with Medicare, Medicaid or private insurance. Dual Medicare-Medicaid patients were assigned to Medicaid. We modeled the log odds of receiving a biosimilar as a function of a three-way interaction between time (month), time-window (windows between biosimilar market introductions), and insurance (Medicare, Medicaid, Private) adjusting for age, sex, race or ethnicity, and socioeconomic status (as measured by Area Deprivation Index (ADI)). We used cluster robust standard errors to account for repeated measures on patients. We reported patient demographics, and adjusted predicted probabilities of receiving a biosimilar by insurance type over time.

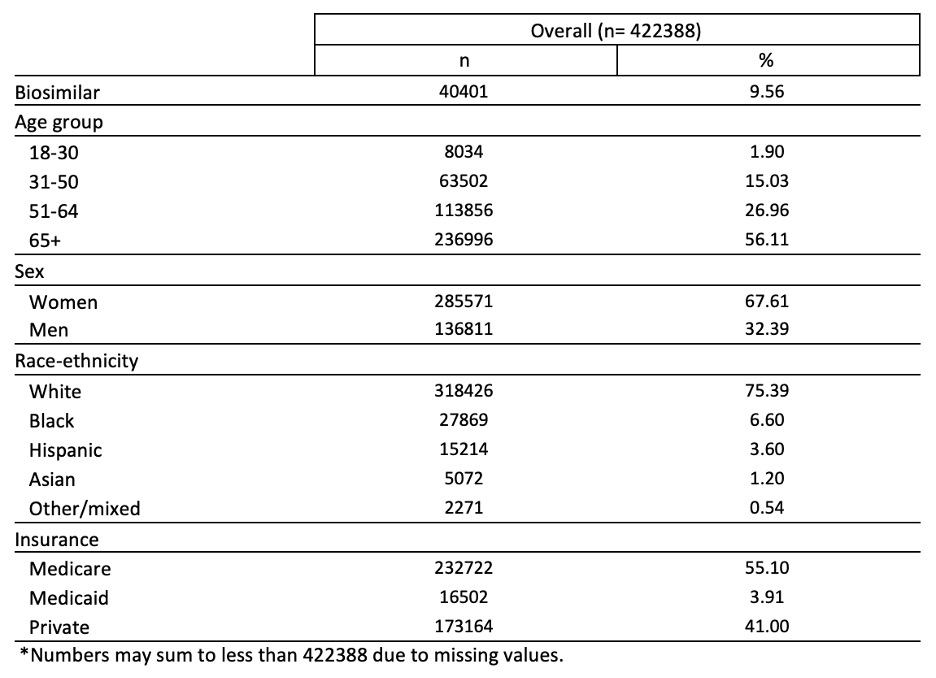

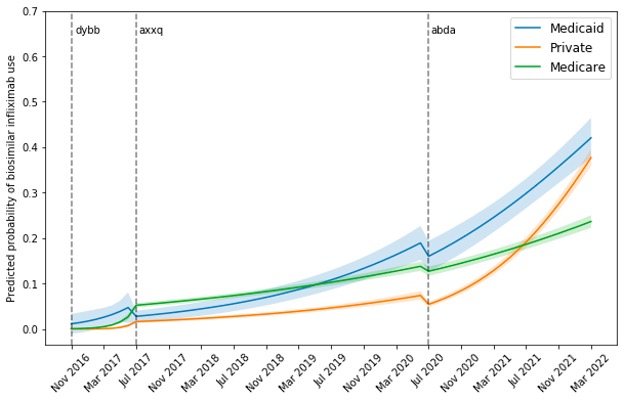

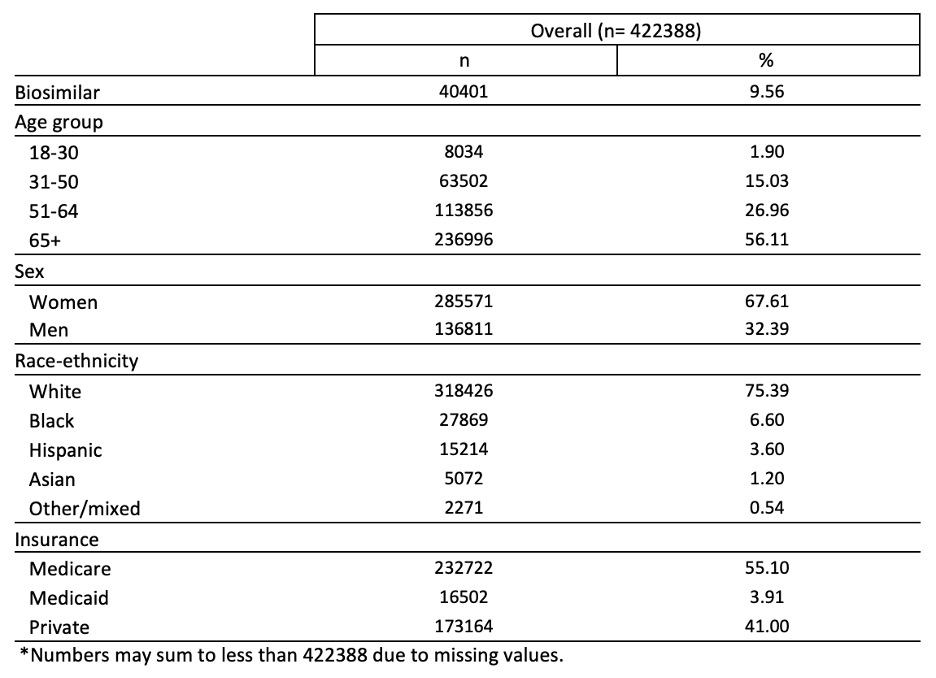

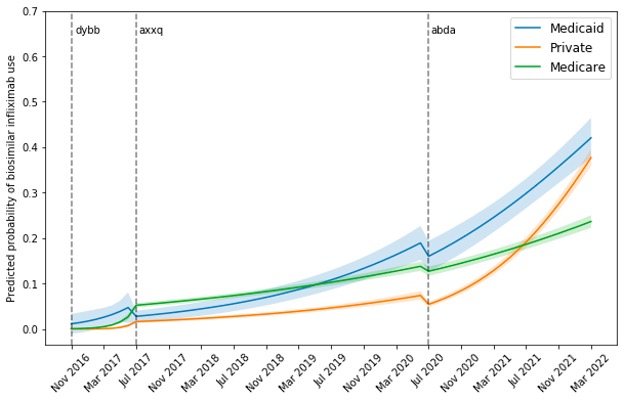

Results: Among 33,751 distinct patients, there were 422,388 administrations of infliximab products in RISE between November 2016 and March 2022, 40,401 (9.6%) of which were for a biosimilar. Overall, 56.1% of patients were ≥65 years; 67.6% were women; 75.4% white; 55.1% had Medicare, 3.9% had Medicaid, and 41% had private insurance (Table 1). Figure 1 depicts the predicted probability of receiving biosimilar infliximab over time by time-window and insurance. After -dyyb (biosimilar #1) came out, uptake for all insurances remained low at less than 10%. With -axxq (biosimilar #2) release, Medicaid was the only insurance to show rapid increase in uptake reaching 19% over 3 years (4 times increase) versus 14% and 7% for Medicare and private insurance. However, after -adba (biosimilar #3) release, both Medicaid and private insurance uptake skyrocketed, reaching similar rates around 40%. Meanwhile, Medicare uptake continued to remain modest at 24%.

Conclusion: Adoption of biosimilar infliximab was quickest for Medicaid, with private insurance catching up after the release of a third biosimilar. Medicare uptake lagged significantly. To reduce drug spending, efforts are needed to understand poor Medicare uptake of biosimilars such as manufacturer rebates for biologics, and lack of financial incentives to switch to biosimilars.

E. Roberts: None; J. Li: None; N. Bansback: None; C. Tseng: Hawaii Medical Services Association Endowed Chair, 5, www.enavvi.com, 1; S. Shiboski: None; G. Schmajuk: None; J. Yazdany: Astra Zeneca, 2, 5, Aurinia, 5, Gilead, 5, Pfizer, 2.

Background/Purpose: The first infliximab biosimilar (infliximab-dybb) entered the U.S. market in 2016, and two additional products have subsequently been introduced (infliximab-axxq (2017) and infliximab-abda (2020)). Biosimilars have significant potential to slow drug spending; however, uptake in the U.S. has lagged behind other countries. We compared rates of biosimilar uptake for Medicare, Medicaid, and private insurance after each infliximab biosimilar approval from 2016 to 2022.

Methods: Data from RISE, a national registry with electronic health records from one-third of U.S. rheumatology practices, was used. We examined all bio-originator or biosimilar infliximab administrations for users ≥ 18 years from the release of -dybb (biosimilar #1) in November 2016 through March 2022 regardless of diagnosis among participants with Medicare, Medicaid or private insurance. Dual Medicare-Medicaid patients were assigned to Medicaid. We modeled the log odds of receiving a biosimilar as a function of a three-way interaction between time (month), time-window (windows between biosimilar market introductions), and insurance (Medicare, Medicaid, Private) adjusting for age, sex, race or ethnicity, and socioeconomic status (as measured by Area Deprivation Index (ADI)). We used cluster robust standard errors to account for repeated measures on patients. We reported patient demographics, and adjusted predicted probabilities of receiving a biosimilar by insurance type over time.

Results: Among 33,751 distinct patients, there were 422,388 administrations of infliximab products in RISE between November 2016 and March 2022, 40,401 (9.6%) of which were for a biosimilar. Overall, 56.1% of patients were ≥65 years; 67.6% were women; 75.4% white; 55.1% had Medicare, 3.9% had Medicaid, and 41% had private insurance (Table 1). Figure 1 depicts the predicted probability of receiving biosimilar infliximab over time by time-window and insurance. After -dyyb (biosimilar #1) came out, uptake for all insurances remained low at less than 10%. With -axxq (biosimilar #2) release, Medicaid was the only insurance to show rapid increase in uptake reaching 19% over 3 years (4 times increase) versus 14% and 7% for Medicare and private insurance. However, after -adba (biosimilar #3) release, both Medicaid and private insurance uptake skyrocketed, reaching similar rates around 40%. Meanwhile, Medicare uptake continued to remain modest at 24%.

Conclusion: Adoption of biosimilar infliximab was quickest for Medicaid, with private insurance catching up after the release of a third biosimilar. Medicare uptake lagged significantly. To reduce drug spending, efforts are needed to understand poor Medicare uptake of biosimilars such as manufacturer rebates for biologics, and lack of financial incentives to switch to biosimilars.

Table 1. Demographic characteristics of infliximab bio-originator or biosimilar recipients in RISE registry between April 2016 and March 2022.

Figure 1. Predicted probability and 95% confidence interval of receiving biosimilar infliximab over time by insurance type

E. Roberts: None; J. Li: None; N. Bansback: None; C. Tseng: Hawaii Medical Services Association Endowed Chair, 5, www.enavvi.com, 1; S. Shiboski: None; G. Schmajuk: None; J. Yazdany: Astra Zeneca, 2, 5, Aurinia, 5, Gilead, 5, Pfizer, 2.